Solutions We Delivered

Mental Health PM+RCM Solution

Built a customized solution to improve revenue cycle and practice management workflows in a mental-health center.

reduction in claims losses

Doctors on Demand Platform

Developed a telehealth platform with virtual streaming capabilities to improve care accessibility and patient engagement.

improvement in home care experience

Ultrasound Analysis and Telehealth

Created an AI-powered ultrasound streaming solution with telehealth capabilities to solve real-time remote diagnosis challenges.

improvement in diagnosing abnormalities

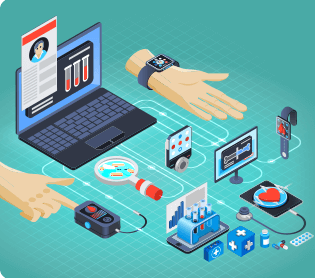

Advanced RPM With Telehealth

Integrated advanced RPM with telehealth and chatbot capabilities to improve chronic care and real-time tracking of patients.

of patients reported a better overall experience

Suicide Risk Assessment and Prevention Software

Developed RPA-powered diagnostic tool to prevent suicide risks in veterans and foster clinical decision-making.

improvement in diagnostic accuracy

Senior Home Care Management Solution

Developed a digital home care solution that improves patient-provider communication, remote care and care coordination.

greater accuracy in health assessment